FACT CHECK: Questions remain over 2025 Jackson County property tax assessment

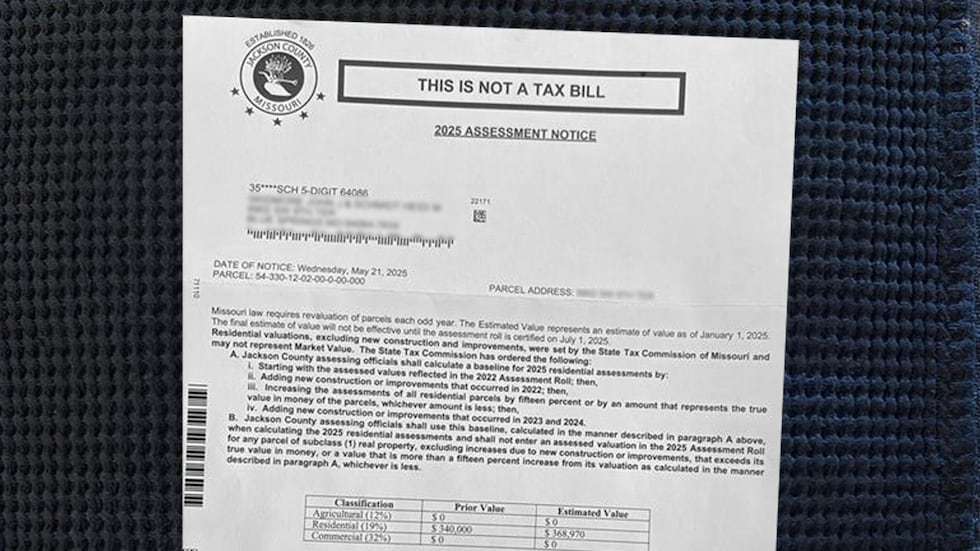

KANSAS CITY, Mo. (KCTV) - If you own property in Jackson County, you have either already received or are about to receive your 2025 property tax assessment notice.

In May, Jackson County said that it would comply with the most recent State Tax Commission’s order.

The order states that the county would go back to the 2022 assessment to get a baseline. Then, it would cap the increases for 2023 at 15% in most cases.

Then, for the 2025 assessment, that increase would again cap the increase at 15 percent in most cases.

But many taxpayers have ed KCTV5 Investigates about the notices now landing in mailboxes.

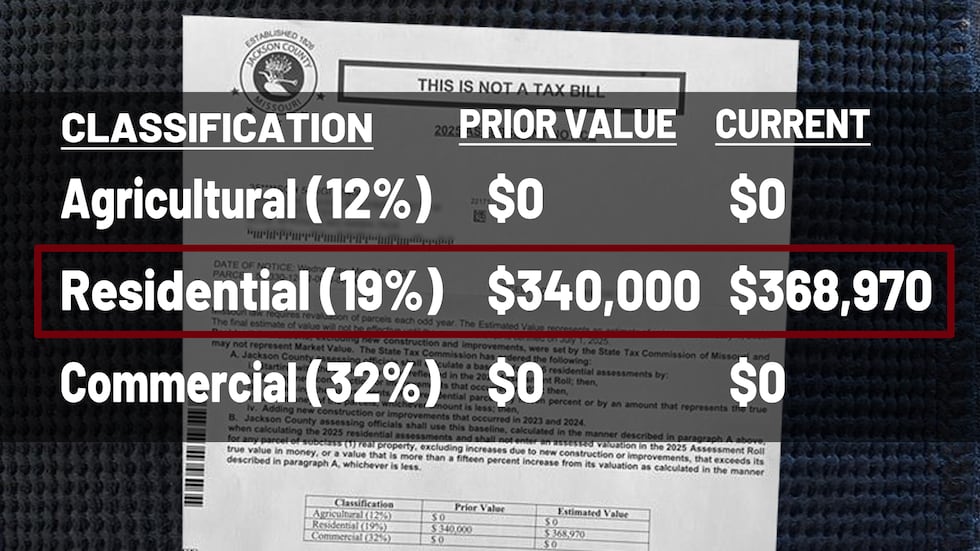

They see that 19% and wonder, “What happened to capping at 15%?”

The 19 percent is not the amount of the increase—it’s the percentage used to determine a property’s assessed value.

That percentage is 19 for residential properties, 32 for commercial properties, and 12 for agricultural properties.

In this example, the prior value was $340,000—the estimated value for the 2025 assessment is $368,970.

To calculate the percentage increase:

- Find the difference between the two values (28,970)

- Divide the difference by the first value (28,970/340,000 = .0852)

- Multiply by 100 (.085 x 100= 8.52 percent)

This property’s assessed value increased by 8.52 percent.

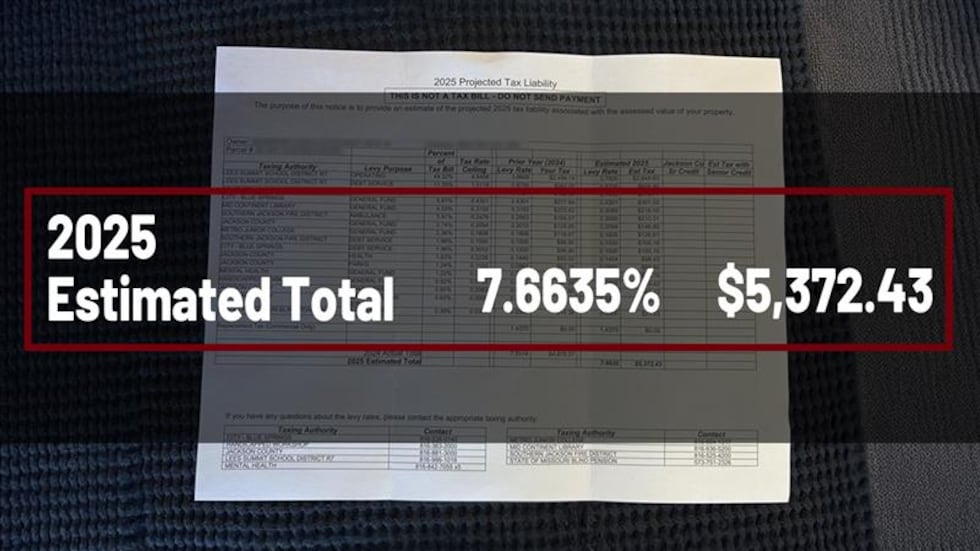

The backside of the assessment notice outlines the tax levy for your area and gives an estimate of what your property tax bill will be.

If your assessment was higher than the STC order, us at [email protected].

For more stories on Jackson County Property Tax reporting, click here.

Copyright 2025 KCTV. All rights reserved.